A MESSAGE FROM TY COCKLE

Posted on August 4, 2020

ALTHOUGH WE HAVE SEEN EXTENSIVE CHANGES TO THE WAY WE ARE ABLE TO CONDUCT OUR BUSINESS, OUR COMMITMENT TO YOU – OUR CLIENTS, IS UNCHANGED.

This is the first of a series of articles to keep you across the measures Financial Foundations are putting in place to ensure that you receive our usual attentive service throughout the current crisis and beyond.

I’m a firm believer in reframing challenges as opportunities and while COVID-19 has put a great deal of pressure on many businesses, Financial Foundations has been able to not only adapt, but implement processes that allow us to elevate what was in place prior to the COVID-19 disruption.

LAYING THE FOUNDATIONS FOR OPERATING THROUGH COVID CONDITIONS

We were able to respond quickly to the changes resulting from the crisis and the team has been working from home since a week prior to the initial government shutdown in March. The transition was quite seamless as we already had the appropriate platforms and processes in place. The situation also presented an opportunity for the business to embrace technology and use it in a manner that was consistent with our longer term strategy. We fast tracked some processes including online document signing via Docusign and the effective use of video conferencing. Moving beyond the present crisis, these technologies will enable us to be more efficient and make accessing advice easier for our clients.

We’ve also been using technology to ensure that our strong group dynamic is not impacted by working remotely, with regular group huddles, quizzes and virtual coffees – endeavouring to do something different every day to keep us all energised and engaged. While we are looking forward to going back to the office (as there is nothing like a face to face connection!) we have adjusted well to our ‘new normal’.

ECONOMIC UPDATE

With June and an extraordinary financial year behind us, it’s a good time to take stock of how the economy is performing.

After 28 years Australia’s record economic expansion ended due to the COVID shutdowns. Our economy contracted by 0.3% in the March quarter and looks set to contract 8% in the June quarter, confirmation that we are officially in recession. The Budget deficit for the 12 months to May was a record $65.5 billion or 3.3% of GDP, $61 billion higher than predicted just last December.

Unemployment rose to 7.1% in May, the highest since 2001, with another 1.6 million Australians on JobKeeper payments. Yet Australia is weathering the COVID storm better than most nations, with signs of building business and consumer confidence. Retail sales rose a record 16.3% in May, after a record 17.7% fall in April, while new vehicle sales fell 35% in the year to May. The ANZ/Roy Morgan consumer confidence index is up 42% on its record lows in March, while the NAB business confidence index rebounded to -20 points in May, up from a record low of -65 points in April.

Financial markets finished the financial year mixed, but in better shape than many feared. In the year to June, US shares rose 4.6% while Australian shares trimmed their losses to 10.8% after a partial rebound in the last quarter. Falling global demand hit crude oil prices (down 33%) and iron ore (down 14%). The Aussie dollar firmed 3.7% in June to finish the year at US69c as a mark of Australia’s sure handling of the COVID crisis.

Our diversified portfolios are holding up extremely well in an environment that has demonstrated considerable turmoil. I encourage any of you with questions or concerns to continue to get in touch with your dedicated adviser.

MOVING INTO THE FUTURE

As always, we strive for continual improvement. We will ensure that future enhancements to the way we conduct our business are appropriate for the current environment. We’d also welcome any feedback for further improvements that would make your lives easier in terms of your interactions with us.

So where to from here for the immediate future? We will continue to do what we excel at, providing advice tailored to your individual circumstances and making sure appropriate investment management is at the forefront of every interaction.

We will be available for every one of you to assist any way we can during a period where there is increased uncertainty and anxiety.

Hoping you and your family stay safe and healthy through the coming weeks.

Stay informed, be engaged.

RECENT POSTS

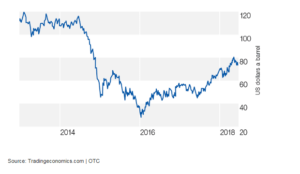

One of the major themes for local investors in 2018 is the fall in the Australian dollar, and it’s not just Aussie travellers heading overseas who are affected. Currency movements can have a big impact on your investment returns, but where there’s risk there’s also opportunity.

What does the Federal Budget mean for me?

Treasurer Jim Chalmers has high hopes that his 2024 Federal Budget will rein in inflation earlier than expected, ease cost-of-living pressures and build a stronger economy in the future.

Last month FFA was honoured to WIN the 2018 “Small Business of the Year Award” at the Greater Dandenong Chamber of Commerce Business awards!