HOUSING PRICES OFF THE BOIL

Posted on October 17, 2018

The Australian housing market appears to have reached a turning point, with prices falling 2.2 per cent since peaking in September 2017. This is welcome news for first home buyers; not so much for sellers and investors.

However, national averages can be misleading. As always with residential property, it’s a tale of many markets with big differences between states, cities and even between suburbs. Before you make any property decisions, it’s important to look beyond the national figures to understand what is happening to prices in your neck of the woods and why.

A TALE OF MANY MARKETS

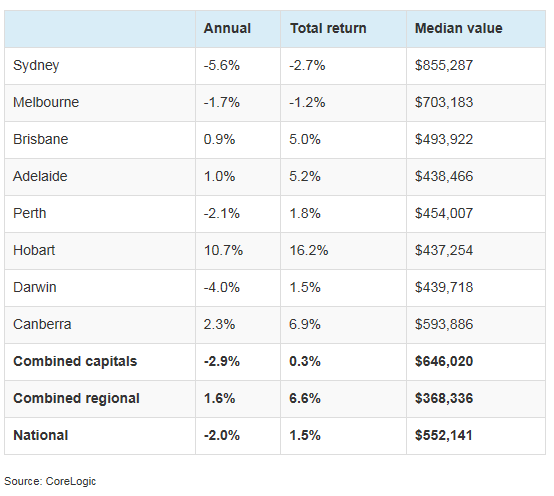

As the table shows, price falls over the past year have been greatest in Sydney (-5.6 per cent), Darwin (-4 per cent), Perth (-2.1 per cent) and Melbourne (-1.7) per cent. The standout performer is Hobart (+10.7 per cent), followed by Canberra (+2.3 per cent), Adelaide (+ 1 per cent) and Brisbane (+0.9 per cent). Regional areas are still rising (+1.6 per cent) as buyers look beyond the big cities.i

Change in dwelling values

There are a variety of factors at play. The Australian Prudential Regulatory Authority (APRA) has imposed tighter lending standards on the banks and encouraged them to restrict higher risk lending, which has slowed market activity. This is reflected in a 3.8 per cent fall in home loan numbers over the past year in all states except Tasmania.ii

There has also been a fall in foreign investment. Last year, Chinese investment in local residential property fell 25 per cent, although Australia still ranks second only to the US as a favoured destination.iii

With fewer buyers in the market and an oversupply of new apartments in Sydney and Melbourne in particular, sellers are having to drop their asking price to compete.

MORTGAGE RATES ON THE RISE

More recently, three of the big four banks and many smaller lenders have lifted mortgage interest rates due to the increased cost of funding. Lenders source much of their funding from overseas markets where interest rates are rising, unlike here where the cash rate remains at an historically low 1.5 per cent.

This raises the bar for first home buyers and puts added pressure on existing borrowers who are already stretched to the limit. But headline rates can be deceiving. Most lenders still offer discounted rates closer to 4 per cent for eligible borrowers.

Rates on interest-only loans, used mostly by investors, have been increasing for some time. Interest-only loans typically have a term of 1-5 years after which they revert to principal and interest payments. This has raised concerns that investors who took out loans at the peak of the housing boom may struggle to meet higher principal and interest payments. Forced sales could lead to further price falls.

However, as Reserve Bank Assistant Governor, Michele Bullock recently said, “borrowers have been transitioning to principal and interest loans for the past couple of years without signs of widespread stress”.iv

AFFORDABILITY A WORRY

Despite falling prices, housing affordability remains an issue, especially for first home buyers in Sydney and Melbourne where home values have soared in recent years. The median home value in Sydney is $855,287, almost twice as much as Hobart ($437,254) and more than twice the regional average ($368,366). But prices are only part of the equation.

Affordability is measured by the share of income required for mortgage repayments. In June 2018, for borrowers with a 20 per cent deposit, the repayment required on the average mortgage amounted to 36.3 per cent of gross household income. Ten years ago, it was 51 per cent. That’s due largely to mortgage interest rates almost halving over the same period, according to CoreLogic’s latest Housing Affordability Report.v

Once again, they are national averages. Sydney and Melbourne are least affordable while Canberra and Darwin are most affordable due to relatively high incomes in Canberra and rising salaries and falling prices in Darwin.

WHAT DOES IT MEAN FOR ME?

For first home buyers, the biggest stumbling block is often saving a deposit as rising prices push desirable properties further out of reach. But with prices expected to fall over the next couple of years, time is on your side.

Now that banks are tightening their lending criteria, self-employed people will need at least three years of tax returns and PAYG earners will have their expenses examined more closely.

Homeowners planning to downsize have an opportunity to sell now near the market peak and buy a smaller property in a falling market. What’s more, if you are over 65 you can put up to $300,000 of the sale proceeds into your super for a significant tax saving.

Families looking to upsize to a larger home also need to weigh up whether it’s better to sell and buy now or wait and see if prices of larger homes fall further. The decision will depend on knowledge of your local market.

As mortgage rates begin to edge higher, all borrowers are urged to stress test their capacity to make higher repayments and adjust household budgets where necessary.

If you are looking to buy or sell a home or an investment property and would like to discuss your options, give us a call.

i https://www.corelogic.com.au/news/augusthomevalueindexresults

ii https://reia.asn.au/media-release/housing-finance-numbers-continue-fall/

iii https://thenewdaily.com.au/money/property/2018/09/11/foreign-investment-real-estate/

iv https://www.rba.gov.au/speeches/2018/sp-ag-2018-09-10.html

v https://www.corelogic.com.au/housingaffordability

RECENT POSTS

It’s February and while the hot weather continues it’s back to business for most of us, with summer holidays, tennis and cricket over for another year. This is a perfect time to revisit your New Year’s resolutions and put all your good intentions to work for the remainder of 2018.

Treasurer Josh Frydenberg has delivered a ‘back in the black’ Budget aimed squarely at voters, stressing the Morrison Government’s commitment to financial discipline and low taxes. As expected, the Treasurer signaled sweeping tax cuts and major infrastructure spending if the Coalition wins the upcoming federal election widely expected to be held in May.

What does the Federal Budget mean for me?

Treasurer Jim Chalmers has high hopes that his 2024 Federal Budget will rein in inflation earlier than expected, ease cost-of-living pressures and build a stronger economy in the future.