Young Invincibles – The Importance Of Insurance

When you are young, healthy and just starting your working life the last thing on your mind is life insurance. In your 20s and 30s your financial focus is more likely to be on saving for a car, holidays, a home or the birth of a child. But failing to protect the lifestyle you are creating could have a devastating financial effect.

Read MoreSpring 2018

September is upon us and spring is in the air. Our farmers and firefighters will be hoping for some soaking rain to ease the drought and ward off bushfires. Meanwhile, AFL and NRL fans will be hoping the sun shines on their team this finals season.

Read MoreMaking The Most Of Falling Aussie Dollar

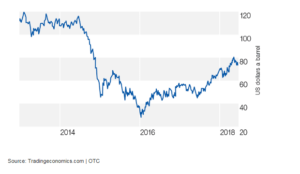

One of the major themes for local investors in 2018 is the fall in the Australian dollar, and it’s not just Aussie travellers heading overseas who are affected. Currency movements can have a big impact on your investment returns, but where there’s risk there’s also opportunity.

Read MoreHave Oil Price Peaked?

Australian motorists are not the only ones hoping that global oil prices have peaked after reaching four-year highs in 2018. Not only do high oil prices flow through to the price of petrol at your local service station, but they also increase the cost of doing business for everyone from farmers to airlines and push up the cost of living for households.

Read MoreWinter 2018

Australia’s national economic agenda in May was dominated by the Federal Budget and the promise of tax cuts. Consumers rode a wave of optimism until the final week of May when the ANZ/Roy Morgan consumer confidence index fell for the first time in 7 weeks, down 3.2 per cent to 117.7.

Read MoreFederal Budget 2018-19 Analysis

The Federal Government has turned the spending tap back on, signalling the end of the revenue drought since the GFC and the end of the mining investment boom.

Read MoreIt’s Time To Talk About Debt

Australia’s household debt is among the highest in the world and rising, thanks largely to worsening housing affordability and plentiful consumer credit. So how do we measure up and should we be worried?

Read MoreChamber Of Commerce Business Awards

Thank-you to our hard working and dedicated team at FFA, we have been nominated for the Greater Dandenong Chamber of Commerce Business of the Year Award!

Read More